Question: Why would I pay more for primary care when I can get it for free?

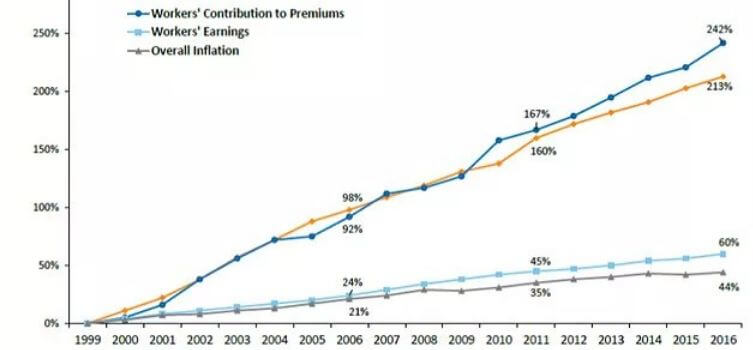

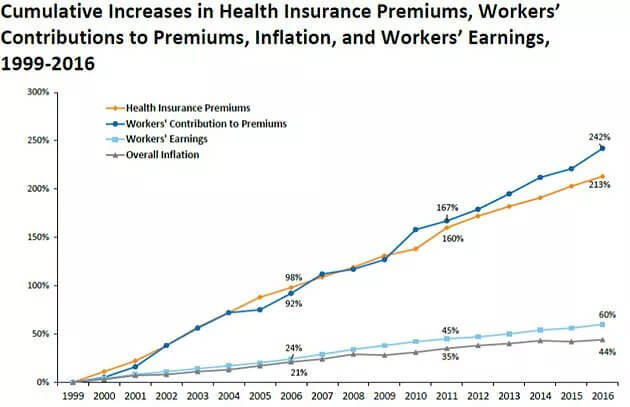

Answer: Because it is not really free. Not only are patients are paying more than ever for insurance premiums, but are then forced to pay inflated prices out-of-pocket for all of their medical expenses until they meet their deductible, which is also increasing dramatically. A membership system that makes primary care more efficient actually saves you money.

Source: http://kff.org/health-costs/report/2016-employer-health-benefits-survey/

Think about the Costco model. There is an initial investment to become a member in the program, and then you have access to a system that actually saves you money.

So how does DPC save patients money?

-

No office charges

-

No primary care copayments

-

No procedure charges

-

Significant discounts on lab tests (in our practice, labs are not balance billed)

-

Discounts on imaging and other tests

-

Avoidance of Urgent Care and the Emergency Room

-

Ability to safely utilize a High Deductible Health Plan

-

Ability to utilize a Health Savings Account (HSA), which uses pre-tax dollars toward medical expenses

The idea that paying “extra” for primary care could possibly save you money is difficult to grasp, so let us consider an example.

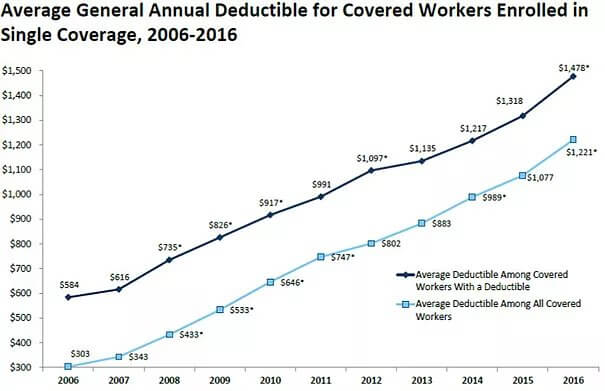

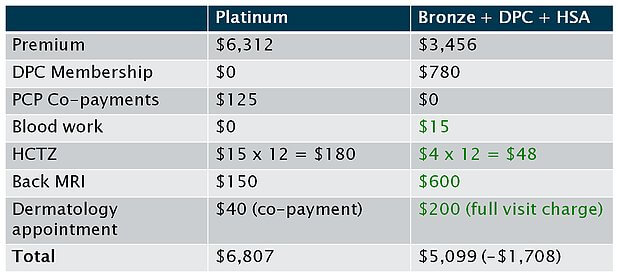

Let’s first consider Alan. Alan is an average healthcare utilizer. He is 40 years old and has a medical history of high blood pressure. He goes to the doctor approximately 5 times per year. During his physical, he gets routine bloodwork (chemistry panel, blood sugar test, and cholesterol panel). His high blood pressure is well-controlled with a medication called hydrochlorothiazide. Over the year, he had an MRI of his back for chronic low back pain. He also spends a lot of time outdoors, so he goes to the Dermatologist once per year for a “mole check.”

Alan considers himself to be responsible, so he has purchased a “Platinum” plan, which is the highest premium, lowest deductible plan. He does this because he believes this is the most responsible thing to do and will give him the greatest level of protection.

Using the above data we have analyzed his projected annual healthcare costs. We have used the Massachusetts healthconnector to estimate these costs associated with the different metallic plans (https://betterhealthconnector.com/help-center-answers/metallic-tiers) and data about insurance premiums (http://www.ncsl.org/research/health/health-insurance-premiums.aspx).

Alan’s healthcare costs with a premium plan:

Premium: $6,312 ($526 / month x 12)

Primary Care Co-payments: $125 ($25 / visit x 5)

Blood work: $0 (With no deductible, the insurance will immediately start paying)

Medication: $180 (Retail Tier I drug is $15 / month x 12)

Back MRI: $150

Dermatology appointment: $40 (specialist co-payment)

Total: $6,807

Let’s say Alan is interested in Direct Primary Care and is wondering if it will save him money. He meets for his initial consultation, and after reviewing his medical records, his doctor determines that he is relatively low-risk and would benefit financially from a higher deductible plan. Alan decides to change to a “bronze” plan, coupled with a Direct Primary Care membership. The excess savings are placed in a Health Savings Account (HSA), which can be utilized pre-tax for future medical expenses. With this strategy, Alan tries to pay cash for routine medical expenses and save his insurance for catastrophic events, so he is still protected if anything serious were to happen to him.

Alan’s healthcare costs with a bronze plan with DPC:

Premium: $3,456 ($288 / month x 12)

DPC Membership: $780 ($65 / month x 12)

Primary Care Co-payments: $0

Blood work: $15 (Patient pays discounted cash price without going through insurance)

Medication: $48 (Patient’s medication is on the Walmart $4 list. $4/month x 12)

Back MRI: $600 (Discounted cash pricing without going through insurance)

Dermatology appointment: $200 (full visit charge)

Total: $5,099

Items listed in green may be paid for using pre-tax dollars using the HSA

So let’s consider Alan’s new situation. He has saved $1,708 per year which is a savings of about 25%. More importantly, he now has access to a doctor who is motivated to spend time with him, keep him healthy, and prevent disease in the future with is one of the biggest financial risks an individual will have in his lifetime. Because of Direct Primary Care, Alan is in much better financial health in both the short and long-term.